Blackline Safety Reports Fiscal Fourth Quarter and Year-End 2022 Results – Record Annual Revenue of $73 Million, Up 34%

Blackline Safety, Leader in Connected Gas Detection & Lone Worker Safety

January 24, 2023

- Q4 revenue of $22.0 million, representing 23rd consecutive quarter of year-over-year revenue growth

- Service revenue up 33% year-over-year to $10.9 million

- Annual recurring revenue growth of 35% to $36.6 million

- Total operating expenses of $20.3 million, achieving cost reduction target to be at or below $21.5 million

- Q4 Adjusted EBITDA loss improves to $7.7 million from $11.5 million sequentially

- Continued growth and cost containment drive momentum towards exiting fiscal 2023 generating Adjusted EBITDA profitability

Calgary, Canada — January 24, 2023 — Blackline Safety Corp. ("Blackline" or the "Company") (TSX: BLN), a global leader in connected safety technology, today reported record fiscal fourth quarter financial results for the period ended October 31, 2022.

Management Commentary

“Our results in Q4 reflect a perpetual theme for Blackline as we were able to grow our top-line for the 23rd consecutive quarter as we continue taking share from competitors with our industry-leading connected safety solutions,” said Cody Slater, CEO and Chair of Blackline Safety. “Equally important, we executed on our cost reduction goal of delivering Q4 total expenses that were at or below Q2 levels of $21.5 million, representing a $4 million reduction from Q3 levels. Looking ahead, we expect to deliver continued revenue growth, coupled with disciplined cost management, which is expected to allow Blackline to exit fiscal 2023 in a position of sustained positive Adjusted EBITDA.

"We concluded fiscal 2022 with revenue growth of 34% compared to fiscal 2021, as Q4 growth was solid at 14%, driven by robust performance from our service side that recorded 33% growth. The outsized service growth also drove our annual recurring revenue(1) 35% higher year-over-year to $36.6 million. Regionally, we saw continued strong performance from Rest of World and Canada, with 105% and 79% growth, respectively. We also are re-establishing momentum in Europe with 13% growth in the quarter and see that region returning to be a solid contributor to our growth trajectory.

“In regards to gross margins, we remain very encouraged with our performance and outlook. Service margins remained strong at 70%, while our product margins increased to 26%, our strongest quarter in fiscal 2022. It is worth noting that our gross margin performance in Q4 received negligible benefit from the 15% pricing increase we recently implemented. We expect to realize this meaningful improvement in product margins in fiscal 2023 and we also see the potential to generate additional product margin enhancement through product redesigns as we incorporate learnings from the G6 into our suite of connected safety solutions. These tailwinds support our view that product and service margins can approach 40% and 75%, respectively, by the end of fiscal 2023.

“We also recently launched our latest product innovation, the G6, with initial shipments to North America and Europe occurring shortly after the start of our fiscal 2023. We believe the product-market fit for the G6 is strong and with our track record of developing innovative solutions in the industrial worker market, we remain excited about the potential the G6 has to disrupt and capture share in the $220 million annual zero-maintenance gas detection market.

“Lastly, we closed two important financings during the quarter to strengthen our financial and liquidity position. We successfully closed a nearly $25 million equity financing, with solid participation from existing investors and insiders and closed on a new $15 million senior secured operating facility. We ended the quarter in a strong financial position with total cash and short-term investments on hand of $31.1 million and are actively assessing multiple financial structures for our finance lease portfolio, which had an undiscounted value of nearly $36 million at the end of the quarter, to supplement our liquidity position as we execute on our path to sustained profitability.”

Fiscal Fourth Quarter 2022 and Recent Financial and Operational Highlights

- Total revenue of $22.0 million, a 14% increase over the prior year’s Q4

- Service revenue of $10.9 million, a 33% increase over the prior year’s Q4

- Product revenue of $11.1 million, consistent with the prior year’s Q4

- Canadian market momentum remains strong with 79% growth over prior year’s Q4

- Europe regaining momentum with 13% growth over prior year’s Q4

- Continued strong growth of 105% in the Rest of World market compared to prior year’s Q4

- Annual recurring revenue(1) growth of 35% year-over-year to $36.6 million

- Implemented global pricing increase on products and services of approximately 15% during Q4, expected to benefit revenue and margins in fiscal 2023 and beyond

- Total expenses of $20.3 million came in below guidance of $21.5 million

- Recent successful launch of G6 single-gas detector and completion of first shipment of orders in North America and Europe in late Q4 fiscal 2022 and early Q1 fiscal 2023

- Closed on previously announced approximately $25 million equity raise in Q4 to strengthen liquidity position

- Closed on previously announced $15 million credit facility with ATB Financial for new operating facility

(1) This news release presents certain non-GAAP and supplementary financial measures, including key performance indicators used by management and typically used by companies in the software-as-a-service industry, as well as non-GAAP ratios to assist readers in understanding the Company’s performance. Further details on these measures and ratios are included in the “Key Performance Indicators,” and “Non-GAAP and Supplementary Financial Measures” sections of this news release.

Financial Highlights

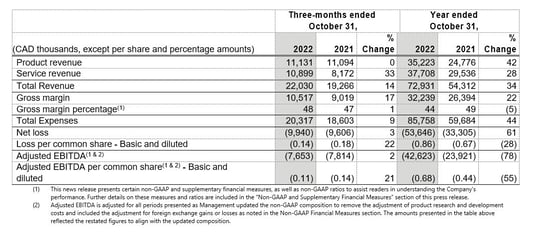

Key Financial Information

Fiscal fourth quarter revenue was $22.0 million, an increase of 14% from $19.3 million in the prior year quarter, with Canada up 79%, Europe up 13%, and Rest of World up 105% being the largest geographic growth regions year-over-year. United States declined 17% from the prior year quarter due to the impact in the prior year quarter from receipt of the largest single order the Company has received.

Service revenue during the fiscal fourth quarter was $10.9 million, an increase of 33% compared to $8.2 million in the prior year quarter. Software services revenue increased 35% to $9.2 million, operating lease revenue decreased 11% to $0.7 million and rental revenue increased 70% to $1.1 million. Software services growth was attributable to new activations of devices sold over the past 12 months. Rental revenue growth continues to be strong as a result of the demand for the Company’s complete suite of connected solutions in the industrial turnaround and maintenance market.

Product revenue during the fiscal fourth quarter was $11.1 million, largely unchanged compared to the prior year quarter. Prior year Q4 hardware sales benefited from the largest sale in Blackline’s history, to a US customer. Finance lease revenue growth of $1.7 million vs the prior year quarter continued to demonstrate the attractiveness of this option for many of our customers.

Overall gross margin percentage for the fiscal fourth quarter was 48%, a 1% increase compared to the prior year quarter. The increase in total gross margin percentage is due to a favourable shift in sales mix with service revenue comprising 49% of total revenue in the fourth quarter, an increase of 7% from the prior year quarter. Product revenue comprised 51% of total revenue in the fourth quarter, a decrease of 7% from the prior year quarter. Service gross margin percentage increased to 70% compared to the prior year quarter at 69% as service revenue continued to grow, absorbing more fixed cost of sales.

Product gross margin percentage decreased to 26% from 30% in the prior year quarter due to G7 EXO contributing a greater proportion of sales in the prior year period as well as inflationary pressures on the costs of certain components in the Company’s devices.

Net loss was $9.9 million, in the fiscal fourth quarter, compared to $9.6 million in the prior year quarter. Net loss increased primarily due to increases to general and administrative expenses, sales and marketing expenses and product research and development costs in the first three quarters of fiscal 2022.

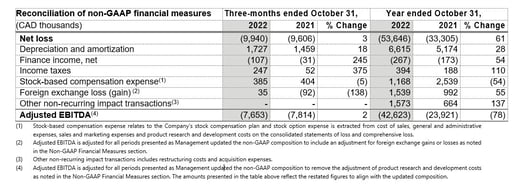

Adjusted EBITDA was ($7.7) million for the fiscal fourth quarter compared to ($7.7) million in the prior year quarter. Note the Company updated its definition of Adjusted EBITDA during the fiscal fourth quarter, to remove the adjustment of product research and development costs and include an adjustment for foreign exchange gains and losses. The comparative period has also been adjusted for this change and is presented on the same basis. This update reflects management’s focus on Adjusted EBITDA profitability as a key performance indicator and to improve comparability to peers.

At quarter end, Blackline had total cash and short-term investments on hand of $31.1 million and $6.4 million of availability on its new senior secured operating facility. The decrease in cash and short-term investments is mainly due to operating losses including the Company’s investment in the G6 product line launching during the fourth quarter of the fiscal year. At quarter end, the Company had $8.6 million of borrowings on its new senior secured operating facility, which was utilized to cover working capital needs of the business.

Blackline’s Annual Condensed Consolidated Financial Statements and Management’s Discussion and Analysis on Financial Condition and Results of Operations for the three months and full-year ended October 31, 2022 are available on SEDAR under the Company’s profile at www.sedar.com. All results are reported in Canadian dollars.

Conference Call

A conference call and live webcast have been scheduled for 11:00 am ET on Tuesday, January 24, 2023. Participants should dial 1-800-319-4610 or +1-416-915-3239 at least 10 minutes prior to the conference time. A live webcast will also be available at https://www.gowebcasting.com/12419. Participants should join the webcast at least 10 minutes prior to the conference time to register and install any necessary software. If you cannot make the call live, a replay will be available within 24 hours by dialing in to dialing 1-800-319-6413 and entering access code 9756.

About Blackline Safety

Blackline Safety is a technology leader driving innovation in the industrial workforce through IoT (Internet of Things). With connected safety devices and predictive analytics, Blackline enables companies to drive towards zero safety incidents and improved operational performance. Blackline provides wearable devices, personal and area gas monitoring, cloud-connected software and data analytics to meet demanding safety challenges and enhance overall productivity for organizations with coverage in more than 100 countries. Armed with cellular and satellite connectivity, Blackline provides a lifeline to tens of thousands of people, having reported over 187 billion data-points and initiated over five million emergency responses. For more information, visit BlacklineSafety.com and connect with us on Facebook, Twitter, LinkedIn and Instagram.

INVESTOR AND ANALYST CONTACTS:

Matt Glover or Jeff Grampp, CFA

Telephone: +1 949 574 3860

MEDIA CONTACT

Christine Gillies, CMO

cgillies@blacklinesafety.com

Telephone: +1 403 629 9434

Non-GAAP and Supplementary Financial Measures

This press release presents certain non-GAAP and supplementary financial measures, including key performance indicators used by management typically used by our competitors in the software-as-a-service industry, as well as non-GAAP ratios to assist readers in understanding the Company’s performance. These measures do not have any standardized meaning and therefore are unlikely to be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Management uses these non-GAAP and supplementary financial measures, as well as non-GAAP ratios and key performance indicators to analyze and evaluate operating performance. Blackline also believes the non-GAAP and supplementary financial measures defined below are commonly used by the investment community for valuation purposes, and are useful complementary measures of profitability, and provide metrics useful in Blackline’s industry.

Throughout this news release, the following terms are used, which do not have a standardized meaning under GAAP.

Key Performance Indicators

The Company recognizes service revenues ratably over the term of the service period under the provisions of agreements with customers. The terms of agreements, combined with high customer retention rates, provides the Company with a significant degree of visibility into near-term revenues. Management uses a number of metrics, including the ones identified below, to measure the Company’s performance and customer trends, which are used to prepare financial plans and shape future strategy. Key performance indicators may be calculated in a manner different than similar key performance indicators used by other companies.

- “Annual recurring revenue” is the total annualized value of recurring service amounts (ultimately recognized as software services revenue) of all service contracts at a point in time. Annualized service amounts are determined solely by reference to the underlying contracts, normalizing for the varying revenue recognition treatments under IFRS 15 Revenue from Contracts with Customers. It excludes one-time fees, such as for non-recurring professional services, and assumes that customers will renew the contractual commitments on a periodic basis as those commitments come up for renewal, unless such renewal is known to be unlikely.

Non-GAAP Financial Measures

A non-GAAP financial measure: (a) depicts the historical or expected future financial performance, financial position or cash of the Company; (b) with respect to its composition, excludes an amount that is included in, or includes an amount that is excluded from, the composition of the most comparable financial measure presented in the primary consolidated financial statements; (c) is not presented in the primary financial statements of the Company; and (d) is not a ratio.

Non-GAAP financial measures presented and discussed in this news release are as follows:

“Adjusted EBITDA” is useful to securities analysts, investors and other interested parties in evaluating operating performance by presenting the results of the Company which excludes the impact of certain non-operational items and certain non-cash and non-recurring items, such as stock compensation expense. Adjusted EBITDA is calculated as earnings before interest expense, interest income, income taxes, depreciation and amortization, stock-based compensation expense, foreign exchange loss (gain), and non-recurring impact transactions, if any. The Company considers an item to be non-recurring when a similar revenue, expense, loss or gain is not reasonably likely to occur within the next two years or has not occurred during the prior two years.

Reconciliation of non-GAAP financial measures

Non-GAAP Ratios

A non-GAAP ratio is a financial measure presented in the form of a ratio, fraction, percentage or similar representation and that has a non-GAAP financial measure as one or more of its components.

Non-GAAP ratios presented and discussed in this news release is follows:

“EBITDA per common share” is useful to securities analysts, investors and other interested parties in evaluating operating and financial performance. EBITDA per common share is calculated on the same basis as net loss per common share, utilizing the basic and diluted weighted average number of common shares outstanding during the periods presented.

“Adjusted EBITDA per common share” is useful to securities analysts, investors and other interested parties in evaluating operating and financial performance. Adjusted EBITDA per common share is calculated on the same basis as net income (loss) per common share, utilizing the basic and diluted weighted average number of common shares outstanding during the periods presented.

Supplementary Financial Measures

A supplementary financial measure: (a) is, or is intended to be, disclosed on a periodic basis to depict the historical or expected future financial performance, financial position or cash flow of the Company; (b) is not presented in the financial statements of the Company; (c) is not a non-GAAP financial measure; and (d) is not a non-GAAP ratio.

Supplementary financial measures presented and discussed in this news release is as follows:

- “Gross margin percentage” represents gross margin as a percentage of revenue

- “Product gross margin percentage” represents product gross margin as a percentage of product revenue

- “Service gross margin percentage” represents service gross margin as a percentage of service revenue

Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively "forward-looking information") within the meaning of applicable securities laws relating to, among other things, Blackline Safety's expectation of deployments being completed in the second half of the year, that the appointment of our Chief Growth Officer will help drive improved operating performance across our regions, including Europe; the evaluation of additional focused measures to optimize operating performance and accelerate timeline to profitability; the forthcoming G6 launch to disrupt the zero maintenance gas detection industrial market, the timeline of launch, and confidence in the potential for the product and service to take share in their respective market. Blackline provided such forward-looking statements in reliance on certain expectations and assumptions that it believes are reasonable at the time, including expectations and assumptions concerning business prospects and opportunities, customer demands, the availability and cost of financing, labor and services, that Blackline will pursue growth strategies and opportunities in the manner described herein, and that it will have sufficient resources and opportunities for the same, or that other strategies or opportunities may be pursued in the future, and the impact of increasing competition. Although Blackline believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Blackline can give no assurance that they will prove to be correct. Forward-looking information addresses future events and conditions, which by their very nature involve inherent risks and uncertainties, including the risks discussed in Blackline's Management's Discussion and Analysis and Annual Information Form for the year ended October 31, 2021 and available on SEDAR at www.sedar.com. Blackline's actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Blackline will derive therefrom. Management has included the above summary of assumptions and risks related to forward-looking information provided in this press release in order to provide readers with a more complete perspective on Blackline's future operations and such information may not be appropriate for other purposes. Readers are cautioned that the foregoing lists of factors are not exhaustive. These forward-looking statements are made as of the date of this press release and Blackline disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.